- The Warmup by Kaizen

- Posts

- Last Dip Before Liftoff

Last Dip Before Liftoff

PLUS: PENGU Fibonacci Bounce

Welcome back to The Warmup.

Happy Monday. We’re starting the week hotter than a CFO adding crypto to the balance sheet.

Here’s what we’re watching:

Market Snapshot

Macro Shift Alert

PENGU Fibonacci Bounce

Arthur Hayes Is Selling

Key Events this Week

Market: Crypto majors are bouncing back after Friday’s dip. BTC is back at $114K, ETH at $3,550, and XRP is leading the rebound. SOL held steady at $162. ENA, XLM, and BONK were the top movers.

Macro Shift Alert

What’s going on:

Things aren’t looking good for the US economy.

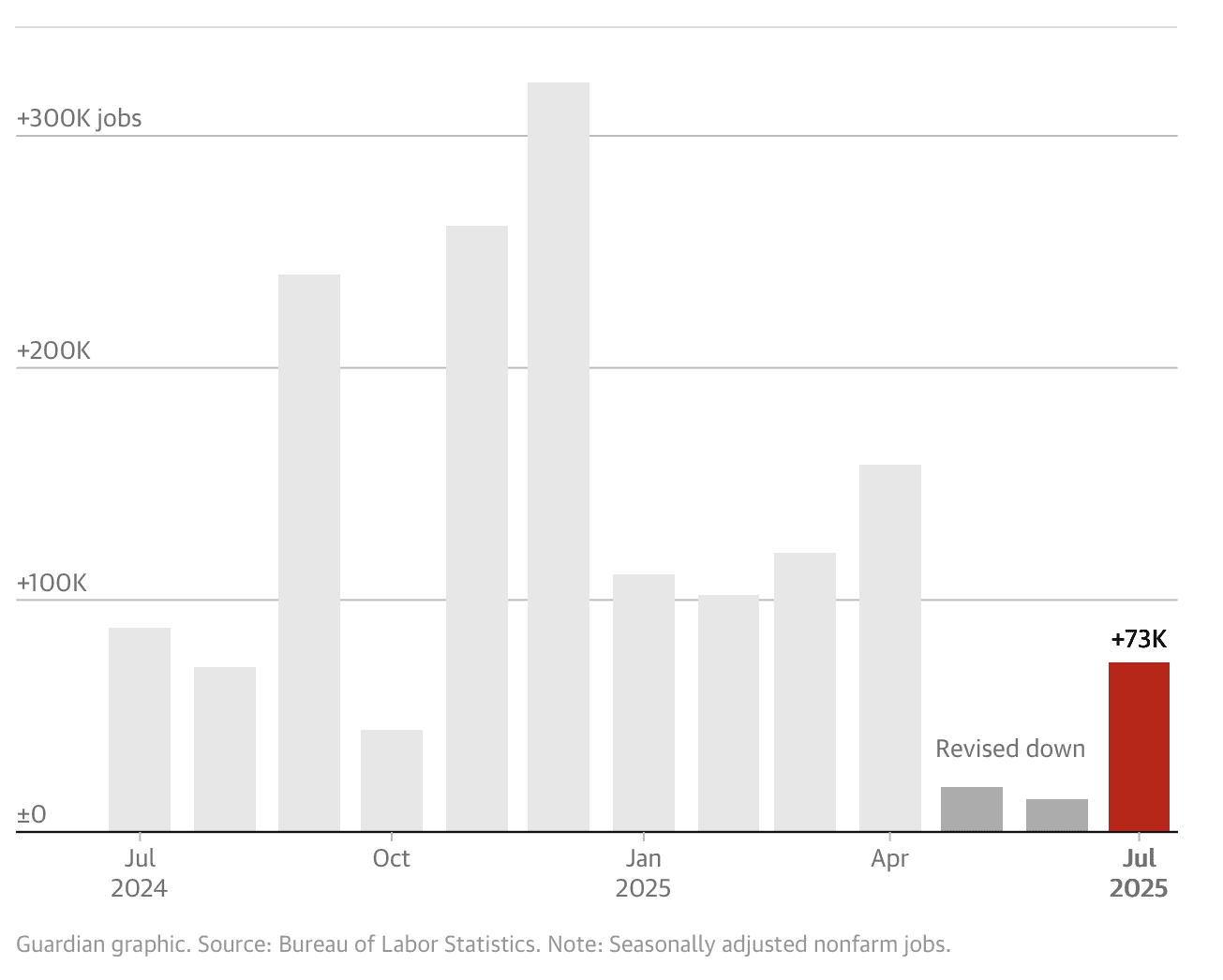

Job growth in July was much lower than expected. Only 73,000 jobs were added, while experts were expecting 109,000. On top of that, the job numbers from May and June were also revised down by over 250,000.

That’s a big miss and it’s making people nervous.

President Trump reacted by firing the head of the Bureau of Labor Statistics.

At the same time, the ISM Manufacturing Index dropped to 48. That number shows the manufacturing industry is shrinking, not growing. It’s the fifth month in a row of contraction.

To top it off, Fed Governor Adriana Kugler just resigned. That gives Trump a chance to add someone new who may support cutting interest rates.

The next Fed meeting is in September. Until then, markets will be watching closely.

What it means:

The pressure is building for the Fed to cut rates.

A weaker job market and slowing manufacturing could force their hand. If rates go down, it usually helps riskier assets like stocks and crypto.

So this isn’t just economic noise. It could be the start of a major shift in how the Fed handles the economy.

PENGU Fibonacci Bounce

What’s going on:

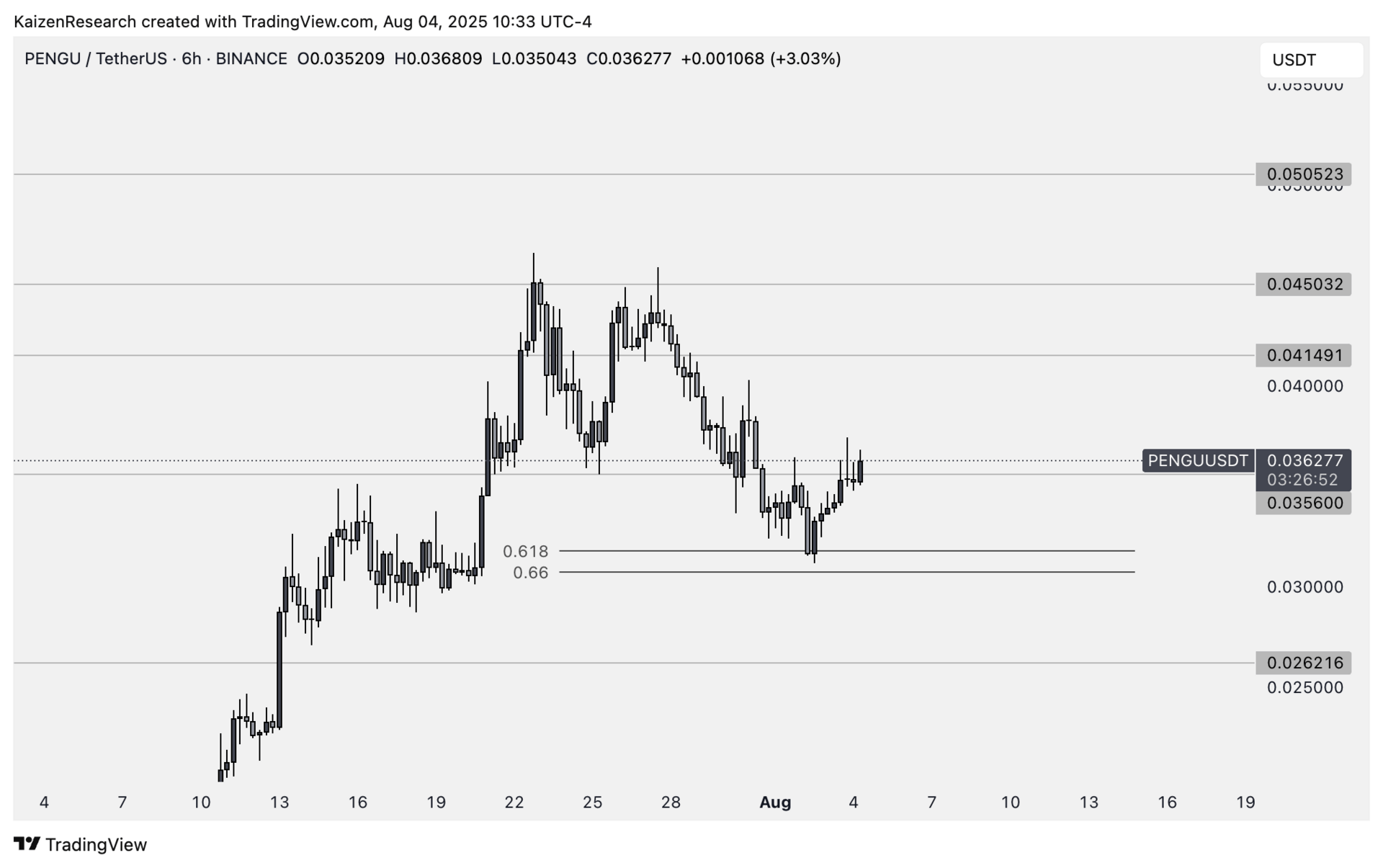

PENGU is showing early signs of strength after a clean retrace to the $0.31 region, right into a Fibonacci golden pocket. The move mirrored SOL’s own bounce off support, suggesting confluence across majors.

Now trading near $0.036, price is recovering with improving volume, a sign of potential trend continuation.

Key levels we’re watching:

Support: $0.031 → golden pocket zone, strong bounce

Resistance: $0.0375 → short-term ceiling to break

Profit zones: $0.041, $0.045, $0.050 → key POIs on the way up

Breakdown risk: Close below $0.030 invalidates setup

Directional Bias: Bullish

The retrace was healthy and well-supported. Needs to reclaim $0.0375 with volume to confirm continuation.

What we’re waiting for:

Spot accumulation or low-leverage longs near $0.036

Volume expansion on breakout above $0.0375

Momentum build toward $0.045+ profit targets

Arthur Hayes Is Selling

What’s going on:

The crypto market hit a $4T milestone in July, with Bitcoin soaring past $123,000 and altcoins like XRP and BNB hitting new highs.

But things have taken a sharp turn. Over the past few days, prices have dropped across the board. Bitcoin dipped under $113,000, and many altcoins are down double digits.

Amid the chaos, big players like Arthur Hayes are cashing out.

Hayes just sold over $8M worth of ETH, $4.6M in ENA, and $414,000 in PEPE. His reason? Trump's new tariffs and rising geopolitical tension. He’s betting that Bitcoin could fall back to $100,000 and Ethereum to $3,000.

He’s not alone. Another whale moved $90M worth of ETH to exchanges in just two days.

We covered Hayes' latest buys in detail last week, check that out here.

What it means:

When whales sell, it’s usually a sign of caution. Hayes is worried about how global events (like tariffs and military moves) could shake markets.

But not everyone’s panicking. SharpLink, the second-largest ETH holder, just bought nearly 15,000 more ETH, bringing their total stash to over $1.6B.

So while some are selling, others are doubling down.

This could mean more short-term volatility, but also potential long-term opportunity for investors who know what they’re holding.

| AAVE: |

| SYRUP: |

| VENTUALS: |

| HYPE: |

Key Events this Week

Solana Seeker Phone Ships (Aug 4): Solana-integrated phone goes live.

DRIFT Fee Model Update (Aug 5): Protocol revises its fee structure, aiming to improve trader incentives.

Magic Eden S2 Airdrop (Aug 6): Season 2 airdrop rolls out, expect NFT buzz.

TOWNS Binance Alpha Listing (Aug 6): TOWNS makes its debut on Binance Alpha, increasing exposure and liquidity.

Reciprocal Tariffs Effective Date (Aug 6): New tariffs come into effect, could weigh on risk sentiment.

US Initial Jobless Claims (Aug 7): Key labor market data ahead of CPI, closely watched by markets.

Russia–Ukraine Ceasefire Deadline (Aug 8): Potential geopolitical volatility catalyst.

CPI Inflation Print (Aug 11): Major macro event, markets watching for signals on Fed’s next move.

Notable mentions:

SUI $162M Token Unlock (Aug 1)

APT $49.7M & LAYER $17M Token Unlocks (Aug 12)

What’s your move this week? |

Bitcoin’s price is increasingly influenced by global liquidity conditions, not just U.S. dollar moves.

As volatility declines, its sensitivity to central bank policies and cross-border capital flows grows.

New research shows over 40% of Bitcoin’s price movements are linked to changes in global liquidity.

To better understand where Bitcoin is heading, investors should track global liquidity trends. Not just BTC/USD.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.