- The Warmup by Kaizen

- Posts

- Wall Street Opens the Door to Crypto

Wall Street Opens the Door to Crypto

PLUS: Ethereum Just Won the Week

Welcome back to The Warmup.

Volatility’s spiking, enough to make Trump stop his speech and peek at a Kaizen ping.

Here’s what we’re watching:

Market Snapshot

Spot Trading Coming to NYSE & Nasdaq

ETH Swing Long

Ethereum Dominates $2.48B Weekly Inflows

What We’re Watching

Market: Crypto majors traded higher with SOL showing the most strength, pushing past $211. Bitcoin hovered near $111,500 and ETH held steady at $4,400. Among top movers, M jumped over 30%, while OKB and Fartcoin also saw notable gains.

Spot Trading Coming to NYSE & Nasdaq

What’s going on:

For the first time, regulators issued a joint statement saying registered exchanges (think NYSE, Nasdaq, CBOE, CME) can facilitate trading of spot BTC, ETH, and other majors under current law.

It’s not a new rule, but it’s clear guidance: file with us, follow margin/settlement rules, add market surveillance, and you’re good to go.

What it means:

Investors will soon be able to buy and trade crypto on the same platforms as stocks.

Spot + derivatives could live under one roof, tightening spreads and cleaning up fragmentation.

It signals a big shift from “enforcement first” to “coordination first.”

This means business and shows the U.S. is finally getting serious about making crypto mainstream.

ETH Swing Long

What’s going on:

Ethereum is sitting right on a strong support zone between $4,200–$4,320, with RSI showing a bullish divergence. That’s a classic setup suggesting buyers may be stepping in.

Key levels we’re watching:

Support: $4,200–$4,320 → DCA zone

Resistance: $4,450 → first upside target

Breakout targets: $4,480 / $4,630 / $4,850 if momentum continues

Breakdown risk: Close below $3,990 invalidates setup

Directional Bias: Cautiously bullish

What we’re waiting for:

Confirmation of buyer strength at support

RSI bullish divergence to play out with momentum shift

Tight risk management with stops just under $3,990

This isn’t without risk, but the reward is attractive if support holds. Managing entries inside the DCA range is key here.

Ethereum Dominates $2.48B Weekly Inflows

What’s going on:

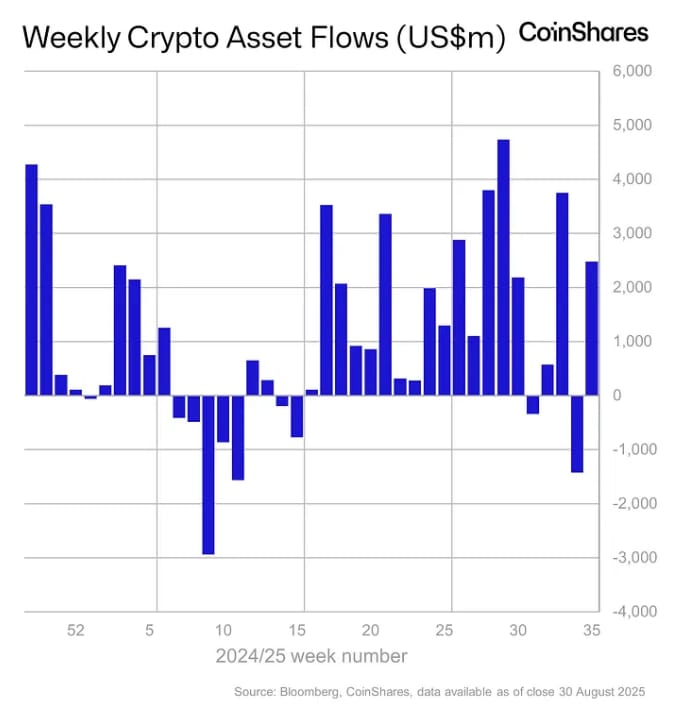

Global crypto investment products pulled in $2.48B in net inflows last week, with Ethereum leading the charge despite choppy markets.

Ethereum funds saw $1.4B in inflows, far outpacing Bitcoin’s $748M. That makes August one of ETH’s strongest months ever, with nearly $4B flowing in, while Bitcoin actually logged $301M in outflows.

Most of the action came from the U.S. ($2.29B), followed by Switzerland, Germany, and Canada. But late in the week, inflows slowed after hot inflation data dampened Fed rate cut hopes, sparking some profit-taking.

What it means:

Institutions are stacking ETH hard, even as prices wobble. That’s a big vote of confidence.

Yes, markets pulled back (BTC slipped under $108K, ETH under $4,300), but the inflow numbers suggest sentiment is still bullish under the surface.

If this trend continues, Ethereum could remain the institutional favorite heading into Q4, setting the stage for a bigger breakout once macro headwinds ease.

| LINK: |

| WLFI: |

| BNB: |

| TRX: |

Will Wall Street Going Crypto Be a Game-Changer? |

We’re taking the contrarian side: while CT screams doom, flows from bigger, slower money are still under-allocated to crypto and every new basis point can push prices higher.

Don’t overfit macro takes to crypto day-to-day, idiosyncratic flows mean BTC/ETH can hold firm even when equities wobble.

Zoom out, manage risk, and give good theses time. Tops in crypto are explosive, not slow grinds.

Edge now comes from doing the work: pick a few ecosystems, go deep, and stay long/strong until the data says otherwise.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.