- The Warmup by Kaizen

- Posts

- Vanguard’s Crypto Pivot

Vanguard’s Crypto Pivot

PLUS: HYPE’s 45% Burn Proposal

Welcome back to The Warmup.

Vanguard might finally let its $11T army buy crypto ETFs and Bitcoin is setting up for a breakout.

Here’s what we’re watching:

Market Snapshot

Vanguard’s Crypto Pivot

Bitcoin Swing Setup

HYPE’s 45% Supply Burn Proposal

Calendar

Market: Overall market cap rose to $16.9B with leaders mostly green as FARTCOIN, VIRTUAL, Aixbt, and ai16z led the top movers.

Vanguard’s Crypto Pivot

What’s going on:

Vanguard, the world’s second-largest asset manager, is exploring whether to let U.S. clients buy spot crypto ETFs through its brokerage platform.

This is a big shift from early 2024 when Vanguard blocked spot Bitcoin ETFs entirely. There’s no final decision or list of products yet, but the move signals that client demand and competitive pressure are getting hard to ignore.

For context, Vanguard oversees about $11 trillion in assets and serves over 50M investors worldwide. Even a cautious rollout would have a massive impact on crypto ETF liquidity.

Adding to the intrigue, Vanguard’s new CEO Salim Ramji was previously at BlackRock and led the launch of IBIT, one of the most successful ETF launches ever.

What it means:

If Vanguard enables crypto ETFs, even with strict limits, it would unlock a flood of fresh inflows into Bitcoin and Ethereum. Retirement accounts could get easier access, and investors who previously moved funds elsewhere could buy directly through Vanguard.

Just 1% of Vanguard’s $11 trillion AUM would translate to about $110 billion in potential inflows. That is enough to deepen liquidity, move prices, and force other holdouts to follow.

More importantly, it would mark a symbolic moment. The same firm that once called crypto “not appropriate for long-term portfolios” could be signaling that Bitcoin and Ethereum deserve a seat at the table with stocks and bonds.

Bitcoin Swing Setup

What’s going on:

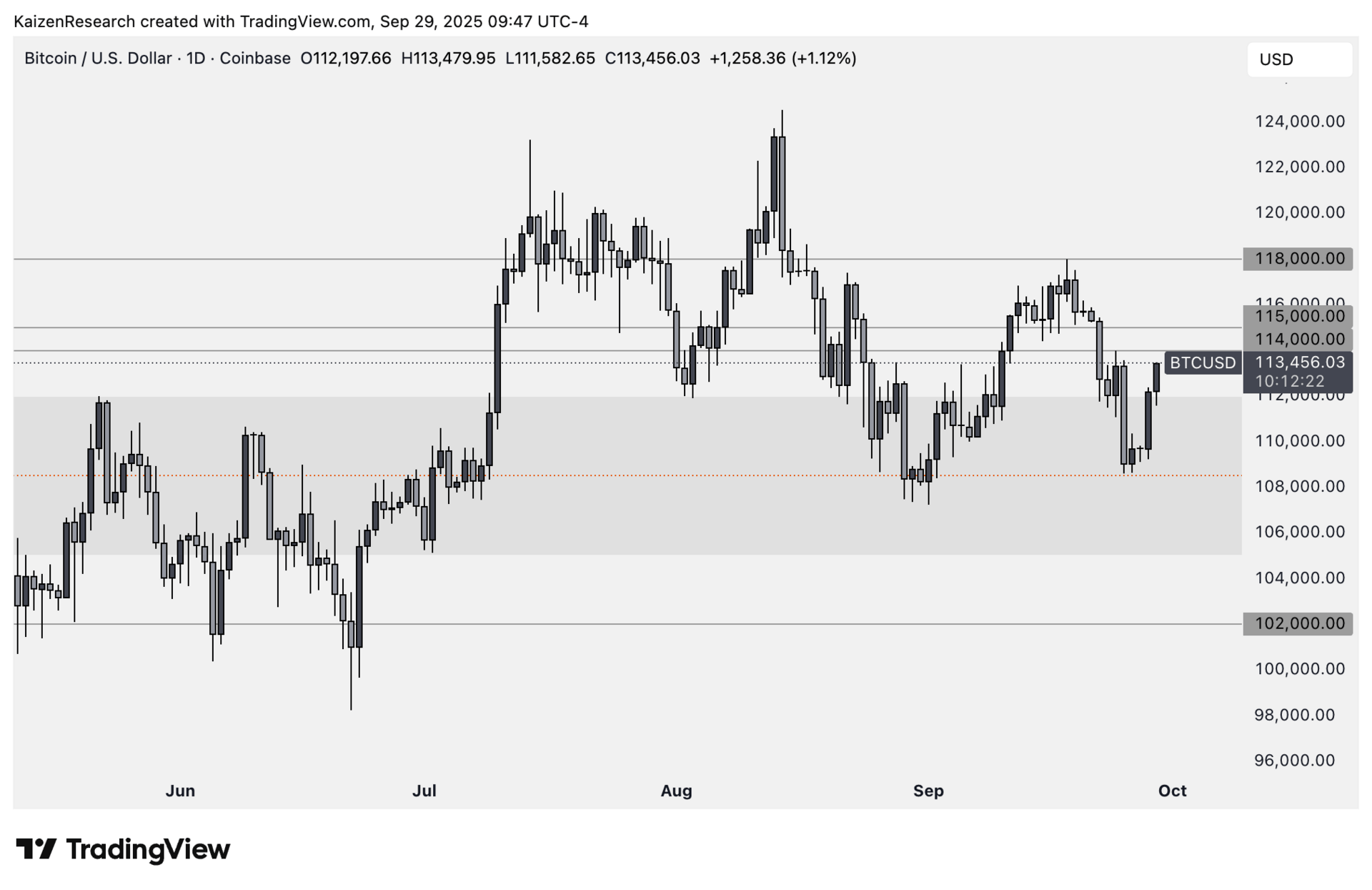

BTC is bouncing from key support levels after a strong daily close, signaling a potential short-term reversal. Price currently sits inside our preferred entry range between $105K–$112K, offering a clear DCA setup.

Momentum looks constructive, and bulls are defending the $105K level well.

Key levels we’re watching:

Entry range: $105K–$112K → ideal spot DCA zone

Targets: $114K, $115K, $118K if momentum continues

Stop loss: Close below $102K invalidates the setup

Directional Bias: Short-term bullish

What we’re waiting for:

Execute DCA:

25% at current price

25% at $111K

25% at $108K

25% at $105K

Confirmation from daily close staying above $105K

Trailing stop updates in real-time as price moves

Risk management is key, stay disciplined inside the entry range and manage exposure.

HYPE’s 45% Supply Burn Proposal

What’s going on:

A bold proposal to burn 45% of HYPE’s total supply has lit up Crypto Twitter and sparked a heated debate. The plan comes from investment manager Jon Charbonneau (DBA Asset Management) and researcher Hasu, and it focuses on closing the massive gap between HYPE’s market cap (about $15.4B) and its FDV (about $46B).

Right now, a large portion of tokens is sitting idle, counted in supply but not circulating. That includes 421M reserved for Future Emissions and Community Rewards (CR) and 31.26M held in the Assistance Fund (AF).

The proposal has three main actions:

Revoke and burn the 421M CR tokens. Future rewards would need a governance vote.

Burn the 31.26M HYPE held by the AF and immediately burn all future buybacks.

Remove the 1B token cap so that any future issuance is governance-controlled rather than pre-allocated.

The goal is to slash FDV so HYPE looks cheaper, making it more appealing to large investors who rely on those metrics.

What it means:

This is less about economics and more about optics. A lower FDV could invite institutional capital and push HYPE’s price higher, which would benefit current holders the most.

Not everyone supports it. Critics argue that burning reserves removes a safety net for hacks or fines, destroys a key incentive pool for future users and stakers, and ignores HYPE’s existing burn mechanisms that already reduce supply as platform usage grows.

Hyperliquid has not taken an official position yet. If the proposal passes, FDV could drop and HYPE’s price could see a significant move up.

| APEX: |

| ASTER: |

| XPL: |

| PNKSTR: |

Key Events this Week

Major token unlocks:

Sui (SUI): ~$140M unlock on Oct 1 (~1.2% of supply)

EigenLayer (EIGEN): ~$68M unlock on Oct 1 (~13.7% of supply)

Ethena (ENA): ~$23M unlock on Oct 2 (~0.6% of supply)

Macroeconomic data calendar:

Tue (Oct 1):

JOLTS Job Openings: Measures how many jobs are available. Fewer openings = cooling labor market.

Consumer Confidence: Gauges how optimistic consumers feel about the economy → higher confidence usually means more spending.

Wed (Oct 2):

ADP Nonfarm Employment: Early look at private-sector job growth before Friday’s big jobs report.

ISM Manufacturing PMI: Tracks manufacturing activity → above 50 signals expansion, below 50 signals contraction.

Thu (Oct 3):

Initial Jobless Claims: Weekly look at layoffs. Rising claims can signal a softer labor market.

Fri (Oct 4):

September Jobs Report: The most important labor release of the month → sets expectations for the Fed’s next move.

Major Earnings Releases:

Tue (Sep 30): Nike

Should HYPE burn 45% of its supply to cut FDV and attract institutions? |

The SEC is working on “generic listing standards” that could make approving new crypto ETPs fast and nearly automatic.

This would open the door for Solana, Chainlink, XRP, and many others to get spot ETPs in the U.S. with far less friction.

It doesn’t guarantee inflows, but it makes it much easier for traditional investors to get exposure when interest picks up.

This could be a major unlock for the next big crypto rally.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.