- The Warmup by Kaizen

- Posts

- Trump + Pantera Fuel the Next Leg Up?

Trump + Pantera Fuel the Next Leg Up?

PLUS: Bitcoin Key Levels to Watch

Welcome back to The Warmup.

Volatility’s running wild, prices are swinging hard and momentum’s flipping by the hour.

Here’s what we’re watching:

Market Snapshot

Trump Media and Crypto.com Launch $6.4B CRO Treasury

Bitcoin Key Levels to Watch

Pantera Seeks $1.25B for Solana Treasury

What We’re Watching

Market: Crypto majors stayed green with SOL stealing the spotlight, jumping to $207 while BTC held $112K and ETH climbed to $4,600. On the leaderboard, CRO, JTO and HYPE led the day’s biggest moves.

Trump Media and Crypto.com Launch $6.4B CRO Treasury

What’s going on:

Trump Media, Yorkville Acquisition Corp, and Crypto.com just announced the creation of Trump Media Group CRO Strategy, Inc.

The new company will hold a massive $6.4B CRO-focused treasury, including $1B worth of CRO (around 6.3B tokens, nearly 19% of the circulating supply), $200M in cash, $220M from warrants, and access to a $5B equity line of credit.

Shares will list on Nasdaq under the ticker “MCGA,” making it the first and largest publicly traded CRO treasury and one of the biggest token treasuries relative to market cap in history.

What it means:

This is a potential game-changer for CRO. With nearly one-fifth of all CRO tokens earmarked for the treasury, supply could tighten dramatically.

On top of that, Trump Media Group CRO Strategy plans to run its own validator, meaning all staking rewards will be recycled back into more CRO, compounding its holdings over time.

The founding partners (Trump Media, Yorkville, and Crypto.com) also agreed to a one-year lock-up and a three-year release schedule, signaling long-term commitment.

This positions CRO not only as a Trump-linked pro-American project, but also as the centerpiece of a U.S.-listed financial vehicle, accessible to institutional capital.

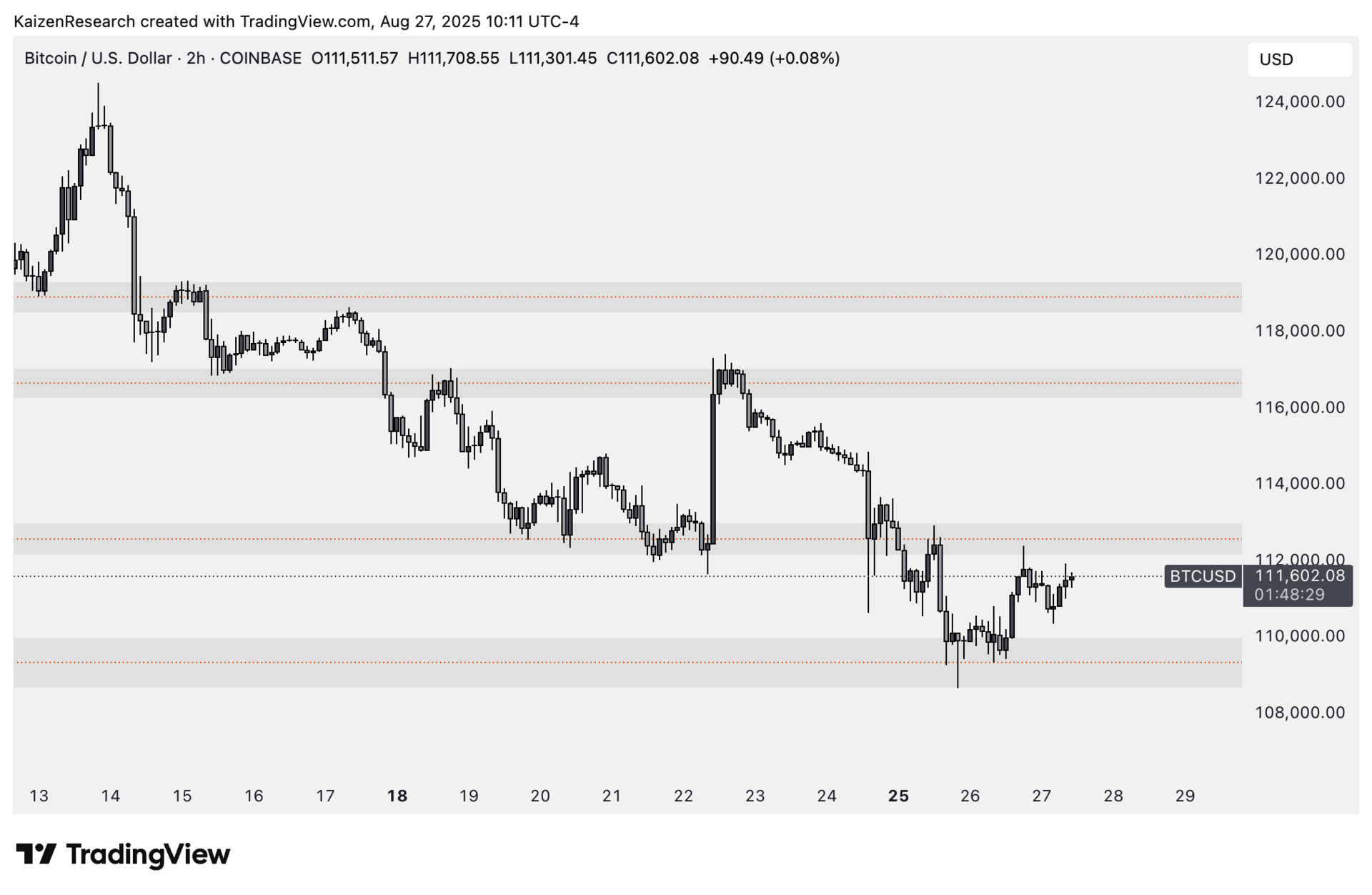

Bitcoin Key Levels to Watch

What’s going on:

Bitcoin is consolidating, but price action is holding around key support.

If buyers can defend this zone and push through resistance, the next upside targets come into play.

Key levels we’re watching:

Support: $108,000–$110,000 — current demand zone keeping BTC stable

Resistance: $112,000 — first major hurdle for bulls

Breakout target: $116,000–$119,000 if momentum kicks in

Breakdown risk: Lose $108,000 and downside opens up

Directional Bias: Cautiously bullish

Momentum looks constructive, but BTC needs to reclaim $112,000 with volume before higher levels unlock.

What we’re waiting for:

Clean defense of $108K–$110K support

Strong volume on any move above $112K

Follow-through toward $116K–$119K if resistance flips

BTC’s setup suggests a potential revisit of upper levels soon but watch these zones closely.

Pantera Seeks $1.25B for Solana Treasury

What’s going on:

Pantera Capital is aiming to raise up to $1.25B to create a U.S.-listed Solana treasury company.

The plan: raise $500M upfront, then another $750M through warrants.

At today’s prices, this would make it the largest corporate Solana treasury in the world, dwarfing the $650M worth of SOL currently held by public companies.

What it means:

Pantera’s move comes right after reports of Galaxy Digital, Jump Crypto, and Multicoin raising $1B for their own Solana treasury.

Together, these firms could control more than $2B in SOL, owning over 2% of the total supply. This is a much bigger bite than Ethereum treasuries have taken so far.

For investors, this signals a shift: Digital Asset Treasuries aren’t just for BTC and ETH anymore. Big names are now moving billions into Solana, creating both a potential supply shock and a new institutional narrative around $SOL.

If ETH treasuries set the blueprint, Solana could be next in line for its own wave of capital-driven momentum.

| HYPE: |

| AAVE: |

| LINK: |

| ETH: |

What’s your take on the $6.4B $CRO treasury? |

Some traders are worried after seeing “doomsday top” posts on X and bearish news calling a Bitcoin peak.

It’s true that BTC had a tough Q4 2024 when global liquidity was shrinking, and the price struggled for a bit. But in Q1 2025, central banks added more liquidity, and Bitcoin bounced back, keeping that momentum strong through Q3.

With liquidity still growing as we enter Q4, the backdrop looks supportive, instead of a final cycle top Bitcoin could still have more room to climb higher.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.