- The Warmup by Kaizen

- Posts

- Robinhood In, MicroStrategy Out

Robinhood In, MicroStrategy Out

PLUS: Ethena loads up with $530M in fresh firepower

Welcome back to The Warmup.

Happy Monday. Fresh week, fresh setups. Charts are lining up and new trading opportunities are already on the table.

Here’s what we’re watching:

Market Snapshot

Robinhood Joins the S&P 500

Litecoin Descending Triangle Setup

Ethena Pops After $530M Treasury Boost

Calendar

Market: Crypto majors are mostly green with SOL leading gains. Top movers include MYX, WLD, PENGU, and SPX.

Robinhood Joins the S&P 500

What’s going on:

Friday brought big moves for companies eyeing the S&P 500. Robinhood (HOOD) officially made the cut, while Strategy (MSTR) was once again left out despite meeting all technical requirements.

HOOD’s stock jumped 7% on the announcement. The company checks the boxes of size, liquidity, and diversification, spanning brokerage, options, cash, card, and crypto services making it a natural fit for the index.

MSTR, on the other hand, still screens more like a Bitcoin proxy than a diversified operating company. Despite holding all the basic qualifications, the committee exercised discretion, passing over MSTR this time.

What it means:

Getting into the S&P 500 isn’t just symbolic, it’s a catalyst. Inclusion drives inflows from index funds and typically boosts short-term stock performance.

Robinhood’s entry signals the committee’s preference for fintech platforms that generate revenue across multiple verticals, including crypto. It validates HOOD as a maturing retail-first fintech story.

MicroStrategy’s exclusion reinforces a clear message: if you want crypto exposure in the index, build a real operating business around it. Simply warehousing Bitcoin won’t cut it.

Litecoin Descending Triangle Setup

What’s going on:

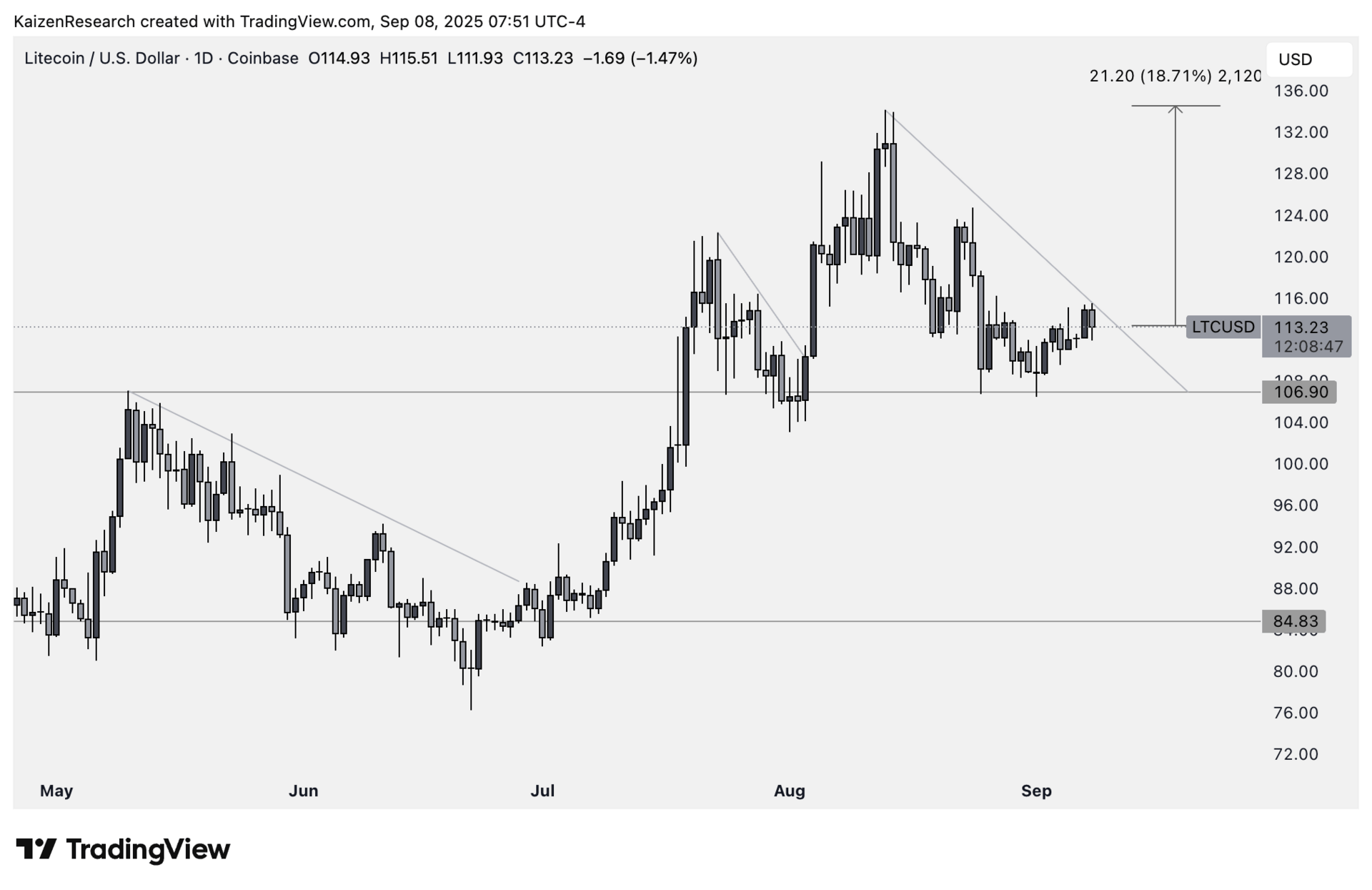

Litecoin (LTC) keeps breaking the rulebook. Descending triangles are usually bearish patterns but LTC has turned the last two into breakout fuel.

Price has now retraced back to the $106 support level twice following previous breakouts. The key question: will history rhyme again, or does this time break the streak?

Key levels we’re watching:

Support: $106 → strong floor tested twice already

Resistance: $115–$117 → descending triangle upper trendline

Breakout target: $134 if bullish momentum confirms

Breakdown risk: Close below $106 could open downside

Directional Bias: Neutral-to-bullish, but pattern edge fading

What we’re waiting for:

A decisive close above $115–$117 with strong bullish candle

Volume confirmation to validate move higher

Litecoin has defied textbook patterns before, but traders should stay cautious. If history repeats, another breakout could be brewing. If not, $106 becomes the line in the sand.

Ethena Pops After $530M Treasury Boost

What’s going on:

Ethena’s native token ENA surged after treasury firm StablecoinX secured a massive $530M investment to expand its accumulation strategy.

StablecoinX, which plans to list on Nasdaq later this year under the ticker USDE, has now raised nearly $900M in PIPE financing. The firm is using these funds to buy locked ENA directly from an Ethena Foundation subsidiary.

That subsidiary, in turn, will scoop up $310M worth of ENA on the open market over the next two months.

The accumulation already shows results: StablecoinX has picked up 7.3% of ENA’s circulating supply in the past six weeks and expects to hit 13% with this latest round.

Even more interesting: Ethena retains veto power over any future token sales, putting a cap on near-term sell pressure.

To top it off, StablecoinX brought in Dragonfly’s Rob Hadick to chair a new strategic advisory board focused on ecosystem alignment and governance.

What it means:

Ethena is getting a double tailwind: rising token demand from a deep-pocketed treasury firm plus a locked-up supply structure that reduces sell pressure.

With Ethena’s synthetic stablecoin USDe now the third-largest in the market (behind Tether and Circle), the project is quickly becoming a major player in the stablecoin wars.

If StablecoinX keeps building its war chest and Ethena keeps growing USDe adoption, ENA could see continued upside momentum.

| HYPE: |

| WLFI: |

| XRP: |

| SOL: |

Key Events this Week

Major token unlocks:

Sei (SEI): ~$45M unlock on September 9 (~5% of its market cap)

Aptos (APT): ~$48M unlock on September 11 (~2.2% of its market cap)

Macroeconomic data calendar:

Tue (Sep 9): 12-Month BLS Data Revision

Wed (Sep 10): August PPI Inflation data

Thu (Sep 11): OPEC Monthly Report, August CPI Inflation data

Fri (Sep 12): Michigan Consumer Sentiment (prelim), Michigan Inflation Expectations

Major Earnings Releases:

Tue (Sep 9): Oracle, GameStop

Who should’ve made the S&P 500 this round? |

August was a rollercoaster. $ETH soared 36% on DAT hype, markets dipped, bounced after Powell’s Jackson Hole comments, and still ended the month mostly flat.

The macro picture shows manufacturing is contracting, but new orders are rising and global liquidity looks ready to expand in Q4 as China pumps cash and the Fed moves toward cuts.

Hyperliquid pulled in $106M to claim 33% of chain revenues while Ethena’s revenues jumped from $10M to $60M.

The takeaway is clear: August wasn’t the top, liquidity is improving, institutions are buying, and we see bullish momentum building into the fall.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.