- The Warmup by Kaizen

- Posts

- Powell Could Light Up Bitcoin

Powell Could Light Up Bitcoin

PLUS: Markets are betting on cuts

Welcome back to The Warmup.

Stocks are falling hard, and fear is starting to creep back in. But markets live on cycles, what looks like pain today often turns into the fuel for the next leg up.

Here’s what we’re watching:

Market Snapshot

All Eyes on Jackson Hole

Bitcoin on the Edge

Solana Pushes Blockchain Speed Limits

What We’re Watching

Market: Crypto majors slipped again with BTC around $113K, ETH at $4.2K, XRP at $2.9, and SOL near $180. OKB and PUMP were the day’s top movers.

All Eyes on Jackson Hole

What’s going on:

This week, the spotlight is on Jackson Hole, Wyoming. The annual gathering of central bankers where Fed Chair Jerome Powell takes the stage.

Why does it matter? Because history shows this is where Fed chairs like to drop big hints:

In 2010, Bernanke teed up QE2.

In 2015, Yellen paved the way for the first post-crisis rate hike.

In 2022, Powell’s “there will be pain” line sparked a brutal tightening cycle.

In 2024, he surprised markets with a dovish pivot, kicking off the rate cuts we’re in now.

This Friday’s speech could set the tone for the rest of 2025.

The backdrop:

Powell is caught in a classic no-win setup.

Jobs are weakening: the latest report showed the slowest 3-month hiring streak since 2020, which argues for cutting rates.

Inflation is heating up: producer prices just spiked 0.9% in a single month, pointing to sticky inflation, which argues for holding steady.

Traders don’t care, they’re already betting on cuts. Markets are pricing an 83% chance of a September rate cut and expect four cuts in the next year.

But Powell hasn’t officially signed off on that yet.

What it means:

Powell’s speech has three possible flavors:

Dovish Powell → Green light for cuts. Stocks, Bitcoin, and gold pump. Dollar drops.

Neutral Powell → Plays for time. Risk assets drift higher, no big shock.

Hawkish Powell → Pushes back on cuts. Equities and crypto sell off. Dollar rips.

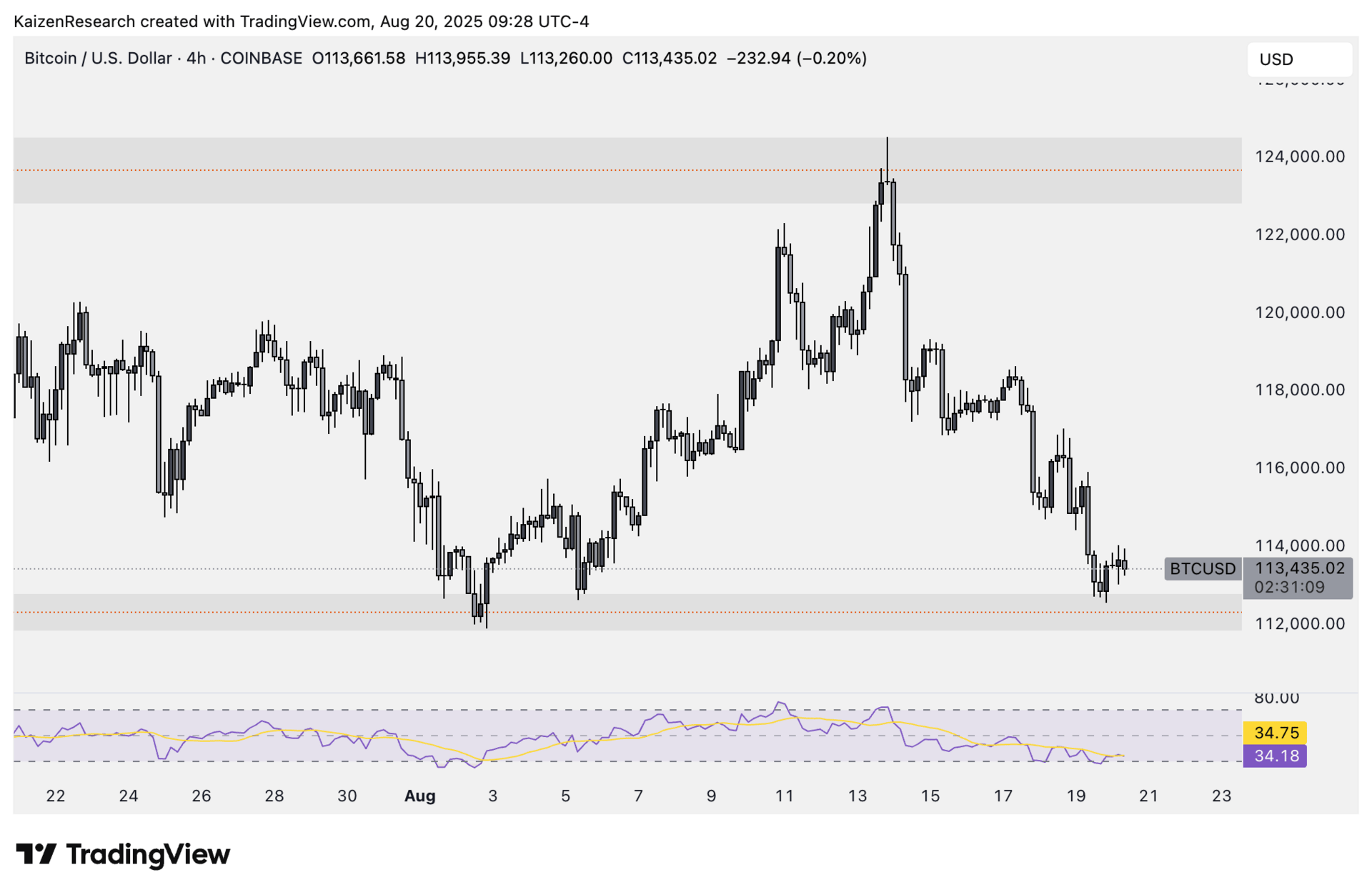

Bitcoin on the Edge

What’s going on:

Bitcoin is sitting on a key support zone around $111,830. This level is critical, lose it and price likely slides to the $107K–$108K region. Hold it, and we could see recovery momentum.

RSI on the 4h chart is oversold, hinting that selling pressure may be slowing, though it can still dip lower. This makes the current support a zone to watch closely for demand.

Key levels we’re watching:

Support: $111,830 → demand zone, needs to hold

Breakdown risk: Below $111,830 → opens door to $107K–$108K

Recovery path: Hold support → potential bounce higher

Momentum check: RSI oversold, watch for stabilization

Directional Bias: Neutral → watching support for confirmation

What we’re waiting for:

Demand confirmation around $111,830

Stabilization of RSI or bullish divergence on lower timeframes

Close monitoring for recovery signs before leaning bullish

Bitcoin’s next move hinges on this support. Hold, and buyers may step in. Lose it, and things could get ugly in the short term.

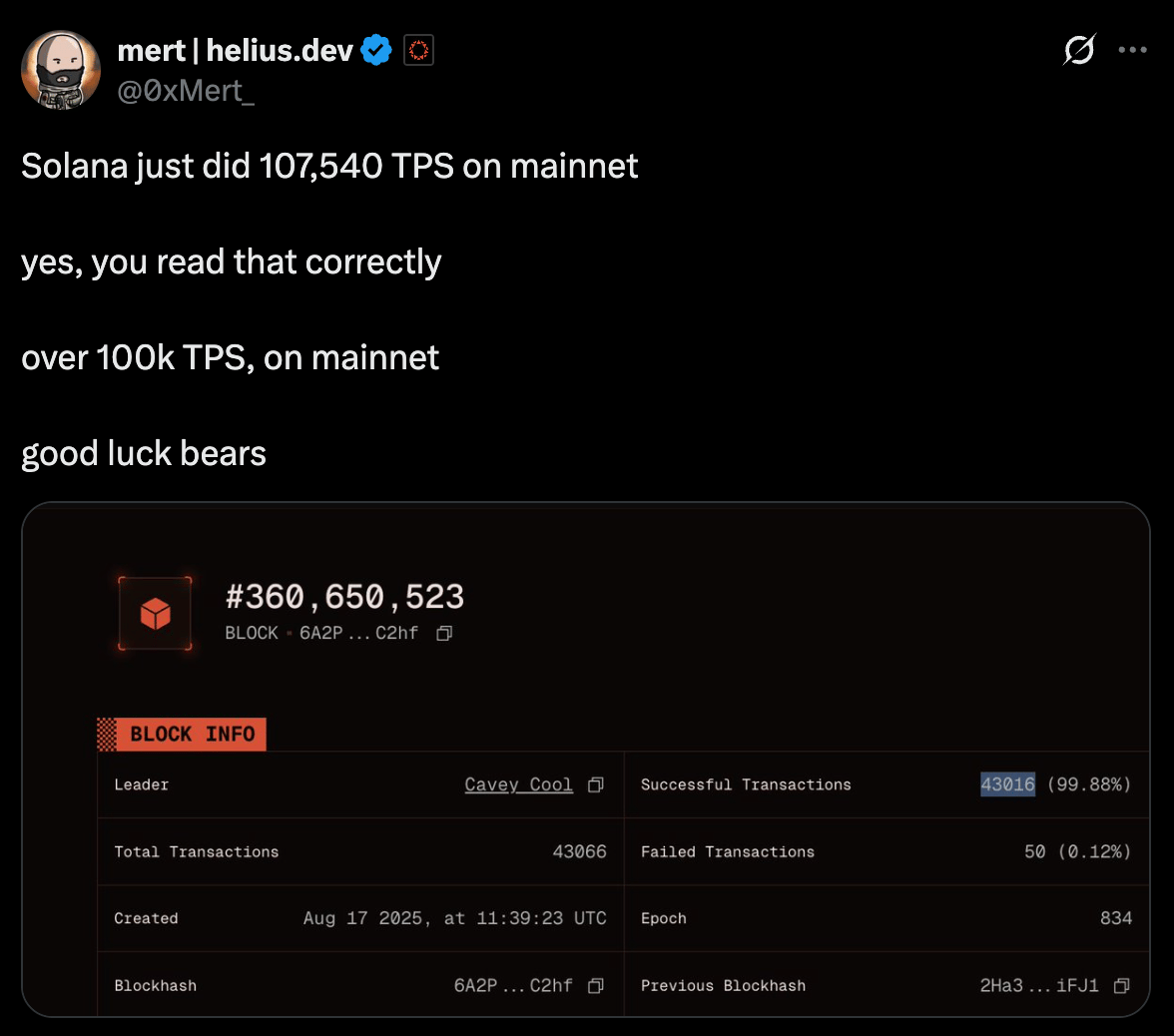

Solana Pushes Blockchain Speed Limits

What’s going on:

Solana just hit a major milestone, briefly processing over 100k transactions per second (TPS) during a live stress test.

That’s well above Visa’s 65,000 TPS and around 25x higher than Solana’s usual throughput.

But there’s an important detail: the test used “no-op” transactions, which are essentially empty actions. They don’t reflect real payments, swaps, or onchain activity.

In real-world usage, Solana typically handles closer to 1,000–1,400 TPS once validator votes are taken out.

Still, developers are optimistic. They believe with better program efficiency, Solana could realistically process 80k–100k token transfers per second, or 10k–20k swaps, within the next 3–6 months.

What it means:

This shows two things: Solana’s technical ceiling is extremely high, but the real challenge is narrowing the gap between lab tests and everyday network activity.

Upcoming upgrades could make that happen:

Alpenglow: A consensus change that could shrink block finality from ~12.8 seconds to just 100–150 milliseconds.

Firedancer: A new validator client from Jump Crypto already tested at over 1M TPS, expected to go live in 2025.

If these upgrades land, Solana could move from “fast in theory” to the backbone of consumer apps, payments, and web-scale crypto.

| LIGHT: |

| SOL: |

| REKT: |

| DOGE: |

Powell Prediction: What’s he bringing to Jackson Hole? |

Global liquidity (the money flowing through markets) jumped $368B last week, now at a record $183T.

This was boosted by a weaker US dollar and calmer bond markets.

History shows that when liquidity rises, stocks, Bitcoin, and gold usually follow higher about three months later, which is playing out now.

Investor sentiment is still risk-on, with Japan and Emerging Markets leading, suggesting there’s room for risk assets to keep running.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.