- The Warmup by Kaizen

- Posts

- ETH’s Supply Crisis Is No Joke

ETH’s Supply Crisis Is No Joke

PLUS: SEC Just Supercharged Crypto

Welcome back to The Warmup.

It’s Wednesday, and the odds of a September rate cut are heating up faster than your microwave lunch.

Here’s what we’re watching:

Market Snapshot

$3B ETH Buy Sparks Supply Crunch

ETH Breakout Watch

Staking Just Got the Green Light

What We’re Watching

Market: Crypto majors are slightly red after Monday’s rebound, with SOL cooling off after its strong run, while PUMP, MNT, and TRON led the day’s top movers.

$3B ETH Buy Sparks Supply Crunch

What’s going on:

Ethereum’s supply is getting squeezed, hard.

A public company called BitMine Immersion (BMNR) just revealed it’s been quietly buying over $3B worth of ETH (833,137 ETH) in the past 35 days.

That’s around 24,000 ETH a day, most of it off-exchange through OTC deals. These buys barely touch public markets, but they drain available supply.

Even more wild? They’re aiming to grab up to 5% of ETH’s entire circulating supply.

At the same time:

Over 40% of ETH is locked in staking, DeFi, and long-term holdings.

ETF inflows are starting to pick up.

New buyers (including public companies) are stepping in.

Meanwhile, not much ETH is being sold. Supply on exchanges is near multi-year lows, and big wallets (whales) are growing.

What it means:

This is basic supply and demand, when supply dries up and demand ramps up, prices tend to go vertical.

BitMine’s move is a clear bet that Ethereum becomes the backbone of global finance, from tokenized real-world assets to stablecoin infrastructure.

And they’re not the only ones.

With institutions competing for a limited pie, ETH could enter a full-blown supply crunch just as retail wakes up and inflows rise.

The bottom line? ETH isn’t just going up because of hype, it’s going up because there’s less and less of it available.

And when that happens, prices don’t climb… they launch.

ETH Breakout Watch

What’s going on:

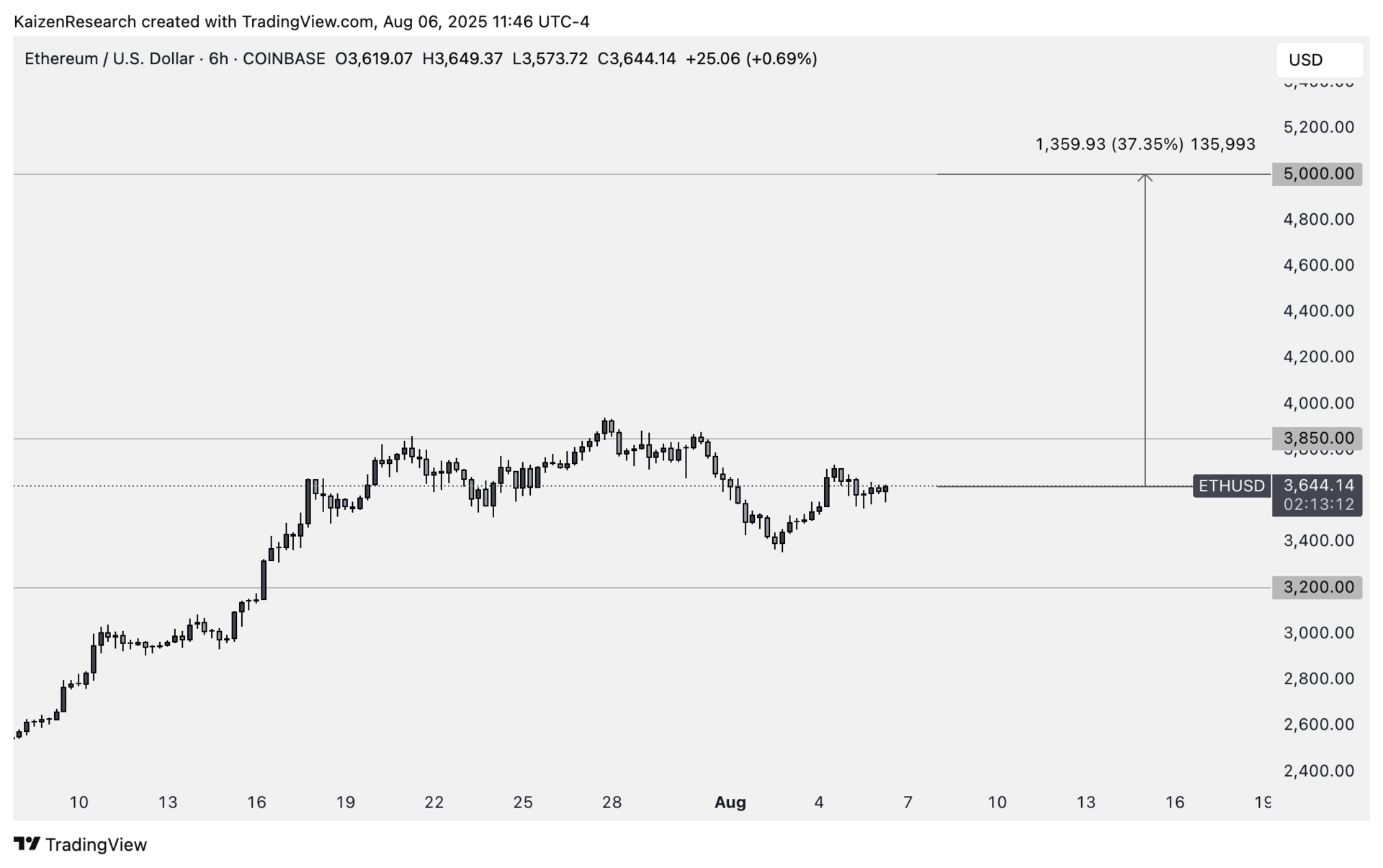

Ethereum is knocking on a major monthly resistance level it hasn’t closed above all cycle.

With strong whale accumulation, rising ETF inflows, and BTC dominance rolling over, ETH is setting up for a potential breakout.

Key levels we’re watching:

Breakout level: $3,850

Target: $5,000+ if momentum builds

Invalidation: Below $3,200

Directional Bias: Bullish continuation if ETH can close above monthly resistance and follow through on ETF inflows

What we’re waiting for:

A strong close above $3,850

Increasing volume and whale inflows

Continuation of BTC dominance topping out

Staking Just Got the Green Light

What’s going on:

That means the tokens they issue (including stETH, mSOL, and jitoSOL) are officially in the clear.

For months, liquid staking was stuck in a legal gray area. The SEC had taken action against some centralized staking services, and there were concerns that even decentralized protocols might be next. Not anymore.

This decision also clears the path for ETH and SOL staking to be included in future spot ETFs.

What it means:

This is a massive win for Ethereum, Solana, and the broader DeFi ecosystem. Lido alone powers over 30% of all staked ETH, and Jito is a key player in Solana’s staking and MEV infrastructure.

More importantly, this sets a precedent. If staking protocols are not securities, that opens the door for other decentralized services to get the same clarity.

Especially in areas like restaking and liquid staking across chains.

The SEC is finally following through on its promise to give crypto real regulatory clarity. And this time, it’s good news.

If you’re serious about trading crypto, it’s time to meet Blofin.

Blofin is a fast-growing exchange offering pro-grade tools for everyday traders without the complexity.

Why traders love Blofin:

🧠 Smart trading features like trailing stops, grid bots, and copy trading

📊 VIP tiers and trading competitions with millions in prizes

🪙 Exclusive perks when you sign up with our link

Since launching, Blofin has quietly become a favorite for high-volume traders who care about performance and speed.

Earn up to $5,000 in deposit bonus when you register today.

| JTO: |

| SBET: |

| SOL: |

| ETH: |

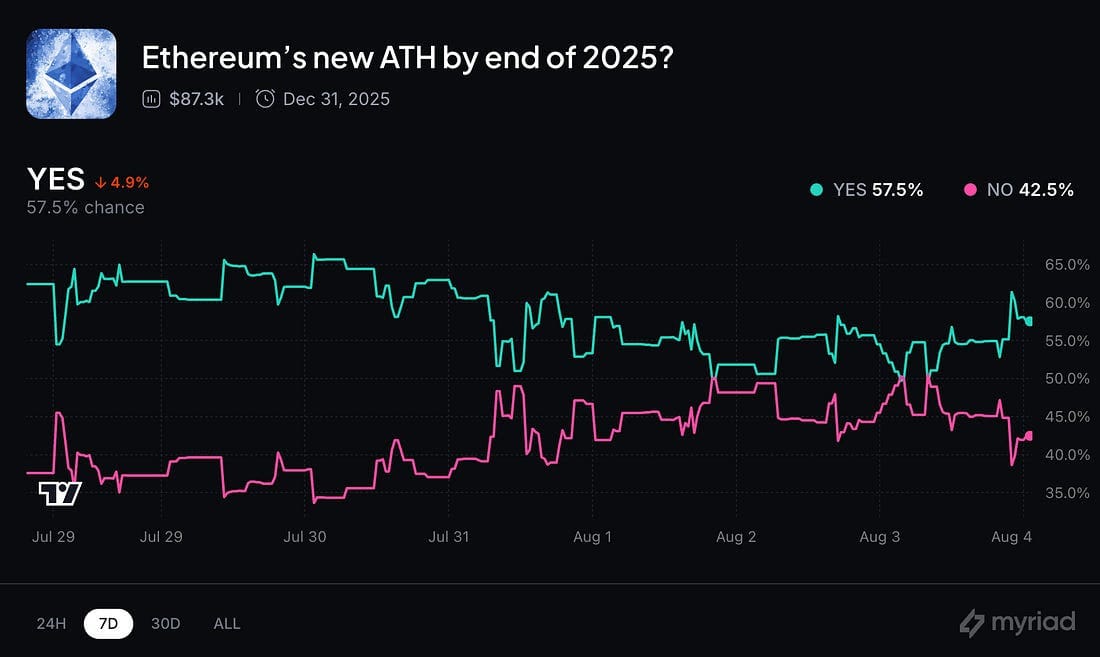

Where do you see ETH by the end of 2025? |

Global liquidity fell by $456B last week, mainly due to a stronger dollar and tighter central banks (China), but it's still growing year-over-year.

This matters because crypto prices tend to follow liquidity trends, usually with a three-month delay.

The recent Q2 liquidity boost is now fueling Bitcoin’s breakout, showing how money flows drive market cycles.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.