- The Warmup by Kaizen

- Posts

- Citi & JPMorgan turn ultra bullish on BTC

Citi & JPMorgan turn ultra bullish on BTC

PLUS: CME Says Crypto Markets Will Never Sleep

Welcome back to The Warmup.

We’re closing out the week, but kicking off Uptober on the right foot.

Here’s what we’re watching:

Market Snapshot

Citi and JPMorgan Call for Bitcoin’s Big Run

SOL Resistance Play

CME Brings 24/7 Futures Trading to Crypto in 2026

Market: Crypto majors turned green with Bitcoin back above $120K, joined by gains in ETH and SOL. Top movers on the day were CAKE, ETHFI, and ASTER.

Citi and JPMorgan Call for Bitcoin’s Big Run

What’s going on:

Wall Street is turning bullish on crypto again.

JPMorgan says Bitcoin is undervalued relative to gold, setting up for a run to $165,000 by year-end. The bank points to the “debasement trade” where retail has been piling into Bitcoin and gold ETFs since late 2024 as faith in fiat weakens.

Citi has also raised its forecasts. It now sees BTC at $132,000 by year-end and $181,000 in 12 months.

Ethereum was not left out, with targets of $4,500 short term and $5,440 over the next year, though Citi notes ETH’s path is harder to model given Layer-2 dynamics.

Flows remain the key driver. Retail inflows into ETFs are strong and institutional demand is slowly catching up as U.S. regulation provides more clarity.

What it means:

Bitcoin is increasingly being framed as digital gold, a hedge against deficits, inflation, and shaky central bank credibility.

The upside case is clear. JPMorgan’s math implies BTC is around 42% undervalued, while Citi says strong inflows could push prices even higher in 2026.

Ethereum may lag in narrative strength, but with compliance tailwinds and steady adoption, it is still positioned for upside.

Bottom line: The “debasement trade” is no longer just a retail story. If Wall Street keeps leaning in, $165K BTC does not look so far-fetched.

SOL Resistance Play

What’s going on:

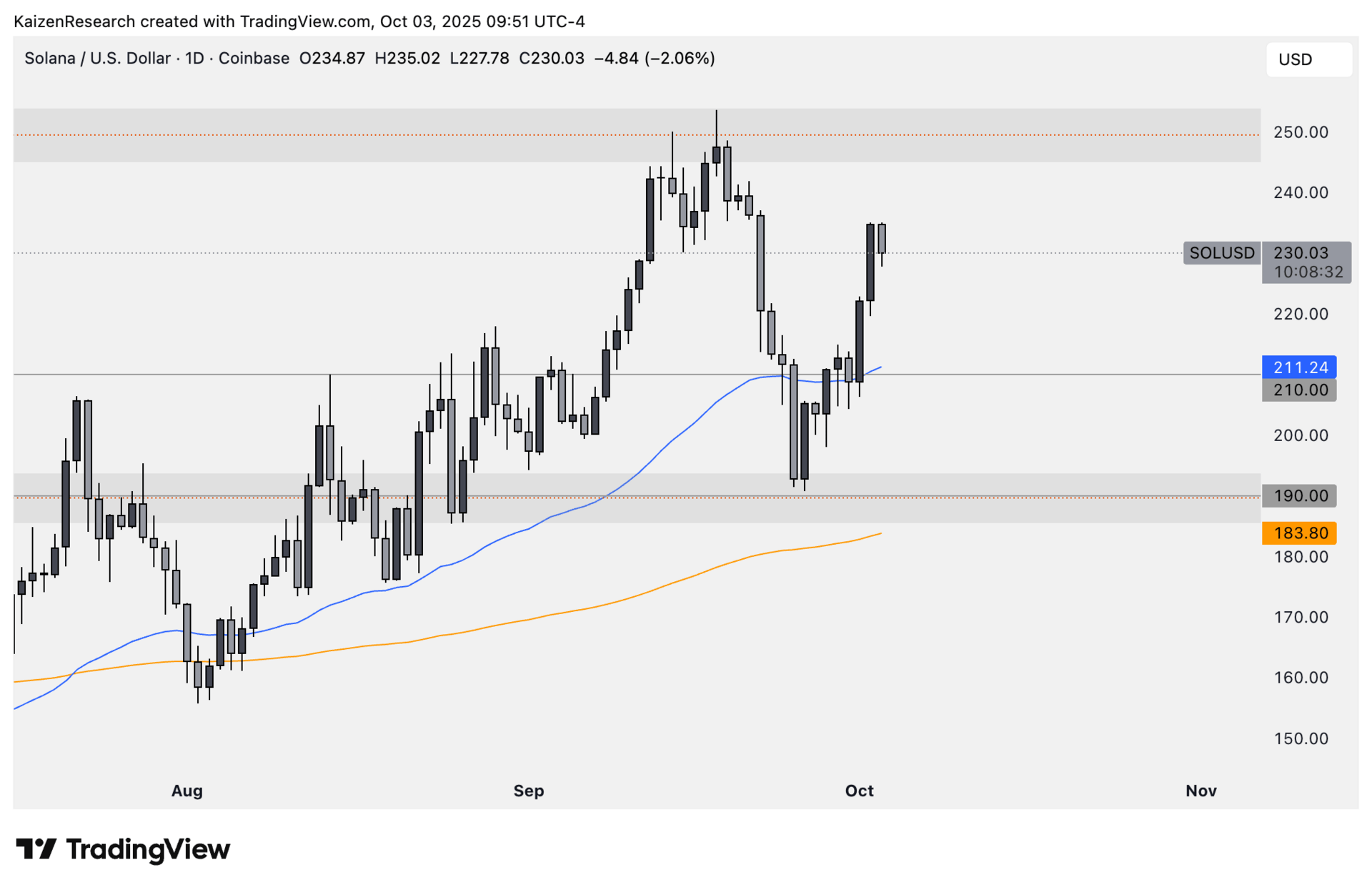

SOL is pushing higher and now eyeing the $245–$253 resistance zone. This area has acted as a major supply block before, making it a likely spot for sellers to step in and force a rejection.

If that happens, bulls may get a chance to reload on a pullback.

Key levels we’re watching:

Resistance: $245–$253 → strong sell zone, rejection risk high

Support / Reload zone: $190–$210 → attractive area for new longs if pullback plays out

Breakout target: $260+ if resistance is flipped into support

Breakdown risk: Close below $180 would weaken bullish structure

Directional Bias: Cautiously bullish

Cautiously bullish. Momentum favors upside, but chasing into resistance carries higher risk. A rejection before continuation is the base case.

What we’re waiting for:

Rejection signals around $245–$253 (wicks, lower timeframe reversals)

Controlled pullback into $190–$210 for fresh accumulation

Breakout confirmation above $253 with strong volume for continuation

SOL isn’t without risk here, upside momentum is strong, but the risk/reward looks best on a pullback rather than forcing entries into heavy resistance.

CME Brings 24/7 Futures Trading to Crypto in 2026

What’s going on:

CME Group just announced that its crypto futures and options will move to 24/7 trading in early 2026, letting clients manage exposure nonstop as demand for regulated derivatives accelerates.

The decision follows CME CEO Terry Duffy’s comments at a joint CFTC and SEC roundtable, where he said “24 seven is coming” across finance, with crypto as the natural first step.

CME’s crypto products have already exploded in activity. Q3 set a record with 340,000 daily contracts traded, equal to $14.1B in notional value. Next up, the exchange will launch options on Solana and XRP futures on Oct. 16.

Other exchange leaders are also leaning into nonstop markets. ICE CEO Jeff Sprecher said markets should decide which assets trade around the clock, while Nasdaq’s Adena Friedman said her firm is preparing for 24/5 equities.

What it means:

Crypto is leading the way in reshaping market structure. If CME succeeds, 24/7 trading could expand into traditional finance.

The shift also points to tokenization as a key enabler, with DRW’s Don Wilson noting that round-the-clock markets need round-the-clock collateral movement.

For now, CME is cementing its role as the global hub for institutional crypto exposure. With record volumes and new products on the way, nonstop trading in 2026 could be the moment regulated crypto markets truly never sleep.

| BNB: |

| SUI: |

| Moonbirds (NFTs): |

| TRON: |

Where do you see Bitcoin by year-end? |

Q4 has a history of being kind to Bitcoin, and this year the setup looks even better.

The big liquidity drain from the Treasury’s cash rebuild is finished (TGA), which means the headwind holding prices down is gone.

If the Fed soon ends balance sheet tightening, that flips the switch from draining to adding liquidity.

And when liquidity comes back, the assets that move fastest are usually tech stocks and Bitcoin.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.