- The Warmup by Kaizen

- Posts

- Bitcoin $150K and Beyond?

Bitcoin $150K and Beyond?

PLUS: SOL Breakout Play

Welcome back to The Warmup.

Stronger than ETH maxis posting victory laps at $4,900.

Here’s what we’re watching:

Market Snapshot

Crypto’s New Fantasy Game Just Exploded

SOL Breakout Play

BitMine Surpasses $8.8B in Treasury

What We’re Watching

Calendar

Market: After a sharp Friday rally, crypto majors pulled back. BTC closed at $112K, ETH at $4.6K, XRP at $3, and SOL at $200. On the positive side, VET, HYPE, and BTT were the top movers.

Crypto’s New Fantasy Game Just Exploded

What’s going on:

Football.Fun, a browser-based Web3 fantasy football (soccer) game built on Base, is exploding in growth and showing shades of 2021 NBA Top Shot hype.

Since launch, activity has skyrocketed:

$25M trading volume

$14M deposits fueling liquidity

10k unique depositors onboarded in under 2 weeks

$1.4M in fees already generated

$3.8M in Gold balances circulating in-game

The ecosystem’s value jumped from $60M to $160M over the weekend.

What it means:

This success reinforces what the focus of consumer crypto apps should be:

Simple UX: No app store, easy wallet/email login.

Strong engagement: Packs, Gold, and tournaments keep users active.

Viral loops: Referrals + scarcity drive growth.

Global appeal: Built around football, the world’s most popular sport.

This is a new kind of crypto trading app. Instead of drafting teams, players buy and trade “shares” of footballers, with prices moving like stocks.

Free packs, in-game Gold, and fantasy tournaments add more layers of strategy and speculation.

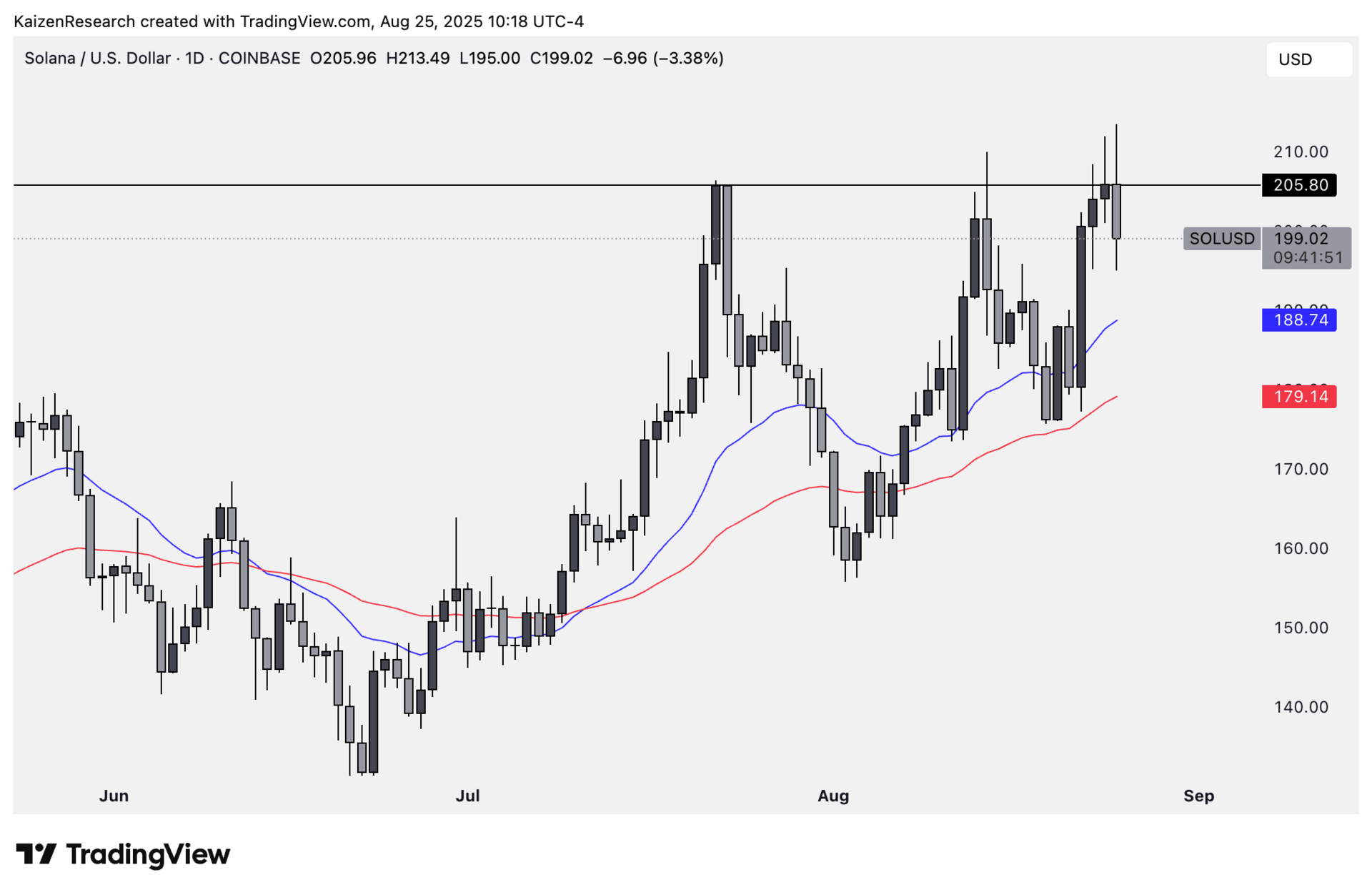

SOL Breakout Play

What’s going on:

SOL just bounced hard off the 50-day EMA (red), showing strong buy pressure at support. Price has rallied straight back into the key resistance zone around $205.

Momentum is heating up, and traders are watching closely for a daily close above this level to confirm a breakout.

Key levels we’re watching:

Support: $188 → 20-day EMA retest as first downside level

Resistance: $205 → major resistance line, needs daily close above

Breakout targets: $220, then $240 if momentum extends

Breakdown risk: Failure at $205 could send price back toward $188 or even $179

Directional Bias: Bullish if breakout confirms

Buyers stepped in aggressively at the 50-day EMA, but SOL now faces its make-or-break moment at resistance. A close above $205 flips this line into support and opens the door for continuation.

What we’re waiting for:

Daily close above $205 to trigger breakout setup

Volume confirmation on the breakout candle

Retest of $188–$179 zone as potential entry if rejection happens

SOL isn’t without risk here, rejection at resistance would mean a pullback. But if bulls push through, upside targets of $220 and $240 look well within reach.

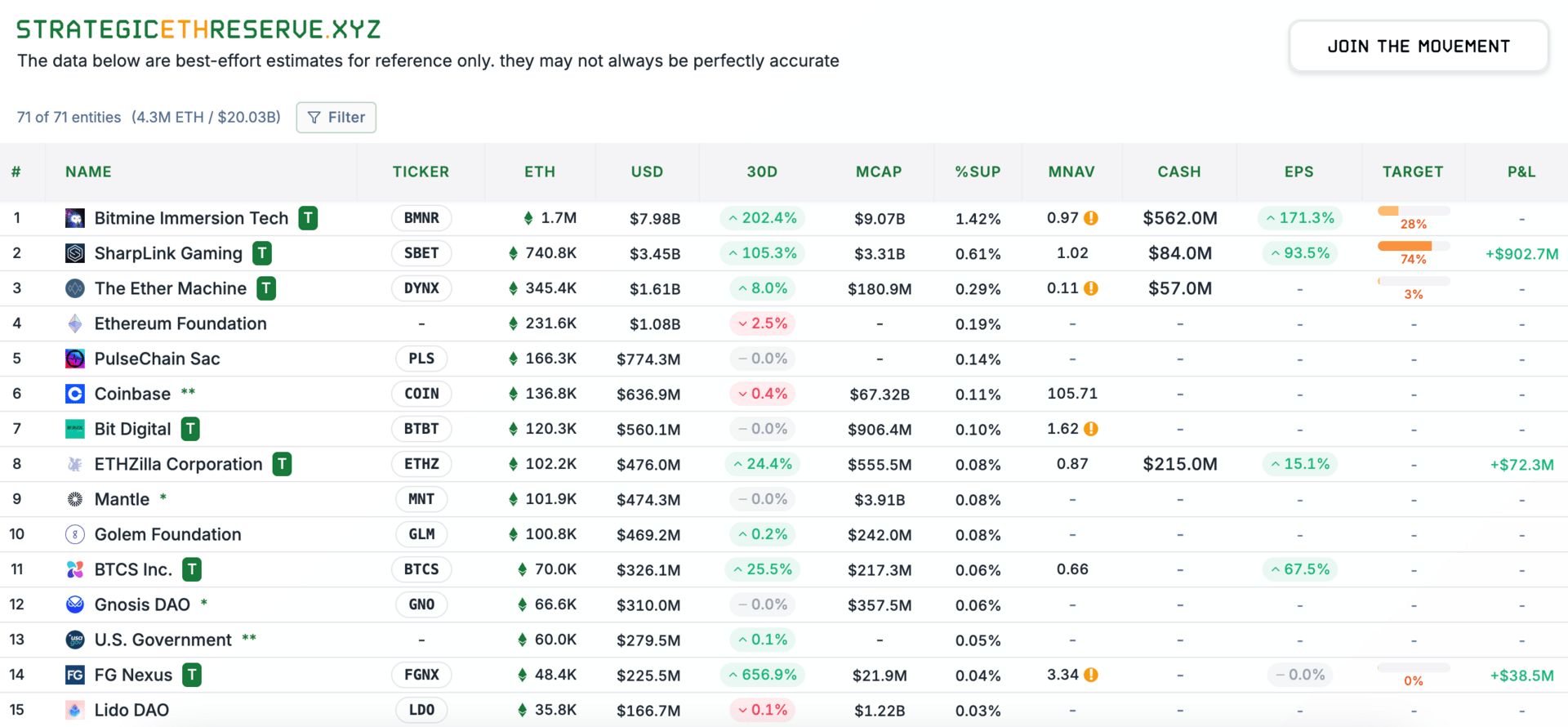

BitMine Surpasses $8.8B in Treasury

What’s going on:

BitMine Immersion Technologies (BMNR) boosted its crypto treasury to $8.82B, cementing itself as the largest corporate holder of Ethereum.

Last week it purchased 190,500 ETH, bringing its total to 1.71M ETH worth about $7.9B. The company also holds 192 BTC and $562M in cash. Its assets are now nearly equal to its $9.2B market cap.

Management reaffirmed a long-term goal of acquiring up to 5% of ETH’s total supply.

What it means:

Corporate ETH treasuries are expanding rapidly this summer alongside institutional inflows.

Public firms now hold more than $12B in ETH, representing over 2% of supply.

ETHZilla, a Peter Thiel-backed treasury fund, lifted its stack to 102,237 ETH.

SharpLink Gaming added another $667M to its ETH balance. BitMine now plays for Ethereum the role MicroStrategy plays for Bitcoin, acting as the bellwether for corporate ETH accumulation.

| HYPE: |

| ENA: |

| JTO: |

| BIG: |

Key Events this Week

Sui Token Unlock (Sep 1): 44M SUI (1.25% of circulating supply) enters the market.

Jupiter Token Unlock (Aug 28): 53.5M JUP (1.8% of circulating supply) enters the market.

Optimism Token Unlock (Aug 31): 31M OP (1.9% of circulating supply) enters the market.

Prelim GDP q/q (Aug 28): First look at how much the U.S. economy grew last quarter. A higher number means stronger growth.

Unemployment Claims (Aug 28): Tracks how many people filed for jobless benefits last week. Fewer claims = stronger job market.

Core PCE Price Index m/m (Aug 29): The Fed’s favorite inflation report. Shows how fast prices are rising, excluding food and energy..

Major Earnings Releases:

Wed (Aug 27): Nvidia, HP, Kohl’s.

Thu (Aug 28): Dell, TD Bank, Best Buy.

Fri (Aug 29): Alibaba.

Will Bitcoin hit $150K by 2025? |

Q1: Where are we in the cycle?

A: Still in “Risk On.” About 59% of markets are in upswing (down from 80%). The drop reflects more speculation, not turbulence. Rate cuts signal ease but don’t add liquidity directly. Liquidity matters more.

Q2: Liquidity cycle peak timing?

A: Likely early 2026. Bitcoin tends to move 3 months after liquidity shifts, not before. Stay alert for the downswing.

Q3: Could BTC hit $150K+ by end of 2025?

A: Plausible. Liquidity could rise to $195T (+8%). That supports BTC in the $150K–$175K range.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.