- The Warmup by Kaizen

- Posts

- All-Time Highs Everywhere

All-Time Highs Everywhere

PLUS: The IPO With All the Right Ingredients

Welcome back to The Warmup.

Stocks have smashed through their previous records, and the bulls are showing no signs of stepping aside.

Here’s what we’re watching:

Market Snapshot

Ethereum’s Mega Treasury Play Is Going Parabolic

Kaizen Trade Setup: $BLSH IPO

Aave’s Parabolic Rise Signals Institutional DeFi Embrace

Market: Crypto majors rallied after a mixed CPI print, led by ETH at $4.6k and SOL at $200. BTC hit $121k, XRP reached $3.28, and top gainers included Fartcoin, AERO, and RAY.

Ethereum’s Mega Treasury Play Is Going Parabolic

What’s going on:

Bitmine Immersion Technologies, led by Tom Lee, has become the first company to hold over 1M ETH in its treasury, now sitting at 1.15M ETH worth nearly $5B. That’s 317K ETH more than just a week ago, adding $2B in value at lightning speed.

The company’s ambition is to control 5% of the entire ETH supply. They already hold 34% of all ETH owned by treasuries, far ahead of second place SharpLink at ~600K ETH.

And they are not slowing down. Bitmine just announced plans to sell up to $20B in stock to buy even more ETH. This “Michael Saylor for Ethereum” move is pushing BMNR stock into the stratosphere, up 1,300% since June, now one of the most traded stocks in the US with $2.2B in daily volume.

Institutional demand is surging too. Ether spot ETFs just saw over $1B in inflows, their highest ever. ETH itself is on a tear, breaking $4,500 and nearing its all-time high.

What it means:

Ethereum treasuries are no longer a niche play. They are becoming a full-on corporate arms race. The combination of aggressive treasury accumulation, ETF inflows, and ETH’s dominance in stablecoin infrastructure is setting the stage for serious supply shock.

If Bitmine hits its 5% goal, the float for ETH will shrink dramatically. With whales, ETFs, and institutions all competing for supply, the potential for a squeeze is real.

This is not just retail FOMO anymore. It is billion-dollar corporate balance sheets making long-term bets on ETH.

Kaizen Trade Setup: $BLSH IPO

Kaizen members got the heads-up from Brian earlier this week. Today it hits the market.

The Setup:

$BLSH (Bullish) is going public on the US stock exchange. For those outside the US, Moomoo was shared as the go-to platform.

This is not just another IPO. The stars are lining up:

IPO momentum is raging: Figma ripped from $33 to $125 in days. Circle’s June IPO ran 400%.

Big money backing: JP Morgan, BlackRock, Ark, Citigroup. Peter Thiel is in with a track record that includes Palantir, SpaceX, Meta, and Airbnb.

Strategic move: Bullish plans to convert a large chunk of IPO proceeds into USD stablecoins, just like Circle did before its run.

Crypto edge: Owns Coindesk, one of the most influential media platforms in the industry.

Macro tailwind: There is an +85% chance of a September rate cut. The market is fully risk-on.

Brian’s Message to Members:

“I’m playing the IPO tomorrow. My exit will depend on volume. Your exit should be based on your own plan. Do not chase someone else’s greed. $BLSH checks all my boxes for a day-one blast. This is a short-term play, not a forever hold.”

The Play:

Entry: Day one listing.

Target: Decide before entry. For example, 40% gain or higher.

Trigger: Watch early volume. If it rips, ride it. If it fades, cut quickly.

Risk: IPOs can turn fast. Position size accordingly.

The last two IPO plays we tracked, $FIG and $FGNX, crushed while the broader market was red. $BLSH has the same DNA.

This could be another one of those days where being early pays.

Aave’s Parabolic Rise Signals Institutional DeFi Embrace

What’s going on:

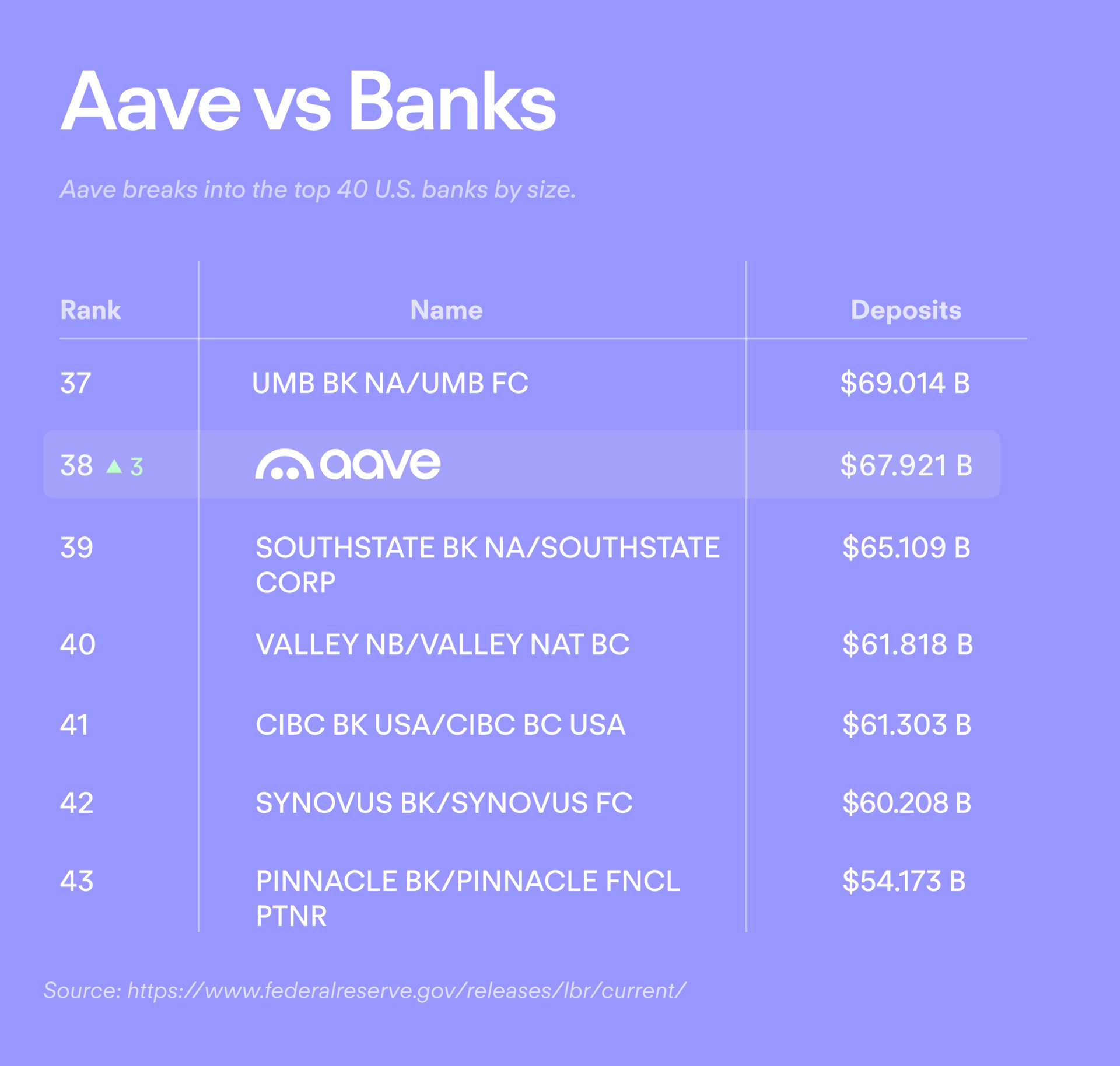

Aave has gone full parabolic. Total value locked exploded from $8B at the start of 2024 to $67B today, cementing its position as the backbone of DeFi lending.

It now controls roughly 80% of all outstanding debt on Ethereum, while its unique borrower base has grown past 1k active users. This dominance underscores Aave’s role as a clear market leader in decentralized lending.

What it means:

Institutions are no longer letting their idle ETH sit around. They are putting it to work in Aave, a battle-tested lending protocol with years of proven performance. By tapping into Aave’s 24/7 permissionless markets, they can earn yield while keeping collateral liquid through tokenized deposits.

This is accelerating DeFi’s shift from an experimental niche to core financial infrastructure. Aave’s dominance in market share, TVL, and reputation for security make it the preferred platform for institutions seeking transparent, compliant, and globally accessible lending.

The signal is clear. DeFi has reached product-market fit and Aave is where institutions are parking their capital to make it work.

| ENA: |

| HYPE: |

| PEPE: |

| WLFI: |

Which play’s got the most juice right now? |

Global liquidity is trending higher, even as central banks in the US, Europe, and Japan keep tightening.

Support is coming from a weaker US dollar, calmer bond markets, and more liquidity from China’s central bank.

Remember: Rising liquidity often boosts risk assets like Bitcoin usually with a three-month lag, and we’ve seen that play out in 2025.

Investors remain in “risk-on” mode globally, with strong sentiment in Japan and steady exposure in emerging markets.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.